Alerts/Notifications Manager (ANM) is an ICD application used to monitor and manage all cardholder alerts. You can perform many of the same functions as cardholders, such as confirming or denying suspicious transactions and overriding transactions. You can also perform administrative functions, such as resending enrollment emails.

ANM is helpful because you can respond to alerts on a cardholder’s behalf when they cannot respond. You can also monitor decline notifications as they come in.

Note: If desired, you can unmask card numbers in Alerts/Notifications Manager. Contact your representative for more information.

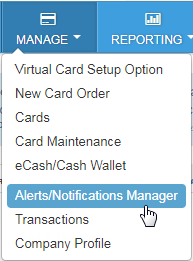

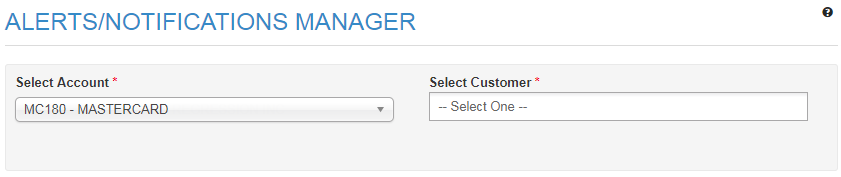

1. Log in to ICD and select Manage > Alerts/Notifications Manager from the ICD menu bar to access.

2. Select an account code and customer ID. Select multiple or all associated customer IDs from the Select Customer drop-down.

3. The page will refresh and display four tabs for managing cardholder fraud alerts and decline notifications: Action Required, Resolved, Enrollments, and Notifications. See the information below to learn about each tab.

Action Required

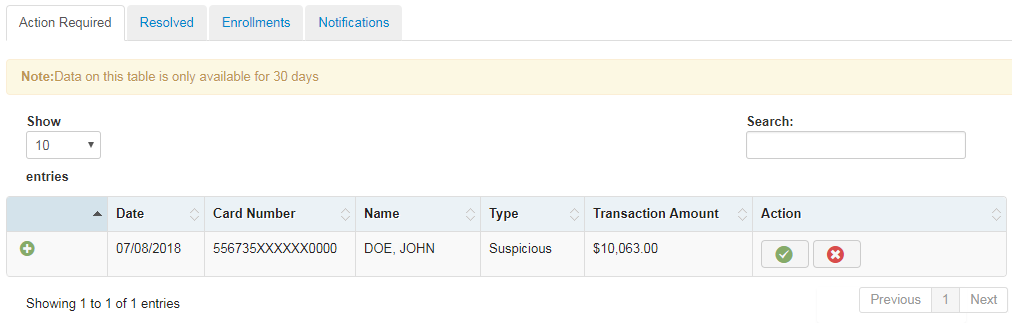

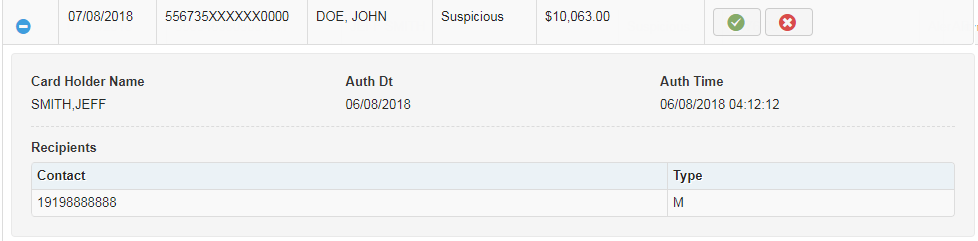

The Action Required tab displays all fraud alerts that have not received a response. The table contains details such as the date each fraud alert was sent, the cardholder’s card number, the type of fraud alert (Suspicious or Confirmed Fraud), and the transaction amount. Data in this tab is available for only the past 30 days.

In the Action column, you can confirm or deny a Suspicious transaction or Override a Fraudulent transaction. Selecting any of the options will remove the alert from the table.

Note: Each tab in ANM also contains a Search field that allows you to search through all alerts and notification history in the table. You can search by any value in the tables (Cardholder name, Date, Card Number, Type, etc.), and the Search field will populate matching results even if you enter as few as two characters.

Also, none of the tabs in ANM will display data for STOP or HELP replies.

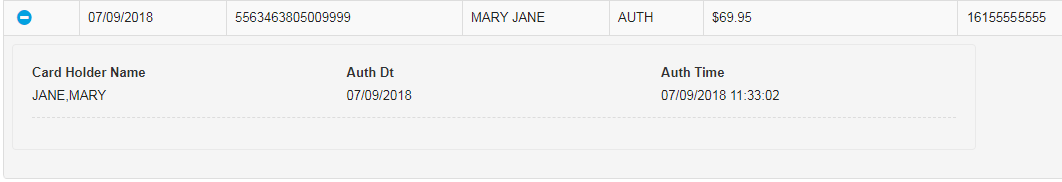

Select the plus icon to view additional details on an alert, such as the authorized date and time. The value in the Type column represents the method in which the recipient was contacted: M (mobile) or E (email).

Resolved

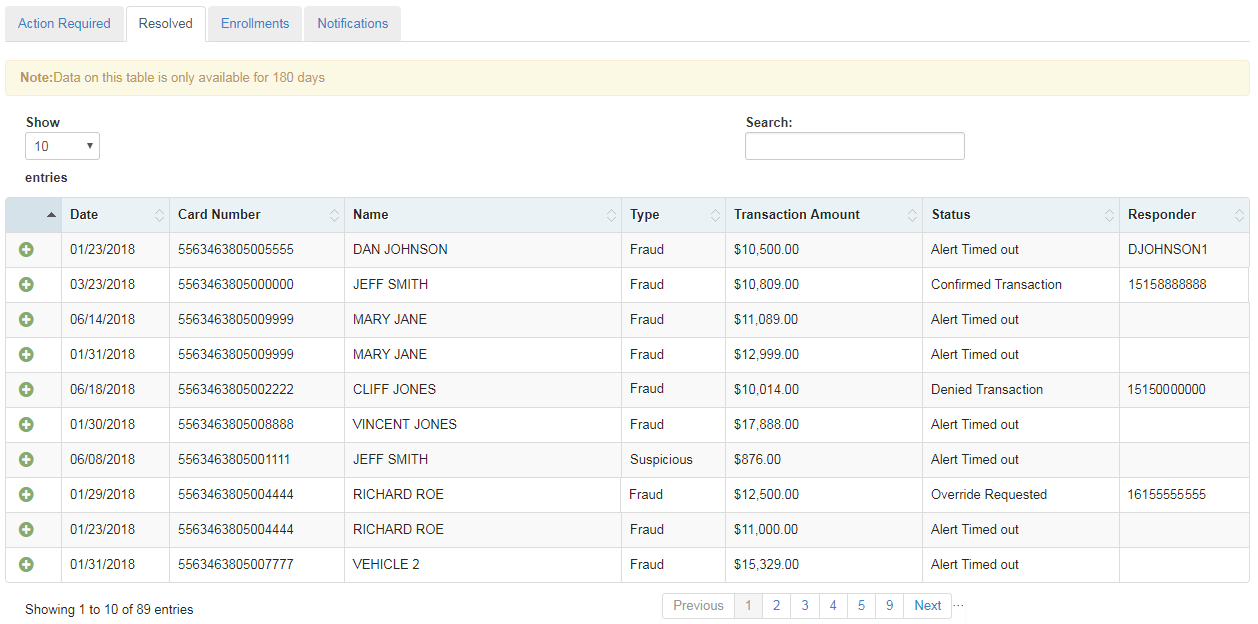

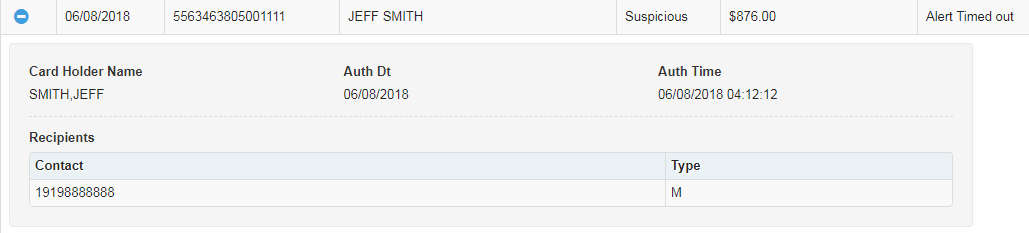

The Resolved tab lists all fraud alerts that have received a final response from the cardholder. The table lists details such as the alert type, transaction amount, final status of the alert (the received response), and the cardholder’s name. Up to 180 days of history will be displayed. Use the Search field to locate a resolved alert quickly.

The Status column can contain the following values: Confirmed Transaction, Denied Transaction, Override, No Contact Found, or Alert Timed Out.

- The Alert Timed Out status represents a Suspicious Alert that the cardholder did not respond to in an appropriate amount of time.

- No Contact Found displays if a cardholder responded to an alert but is not enrolled in Alerts and Notifications.

- The Responder column displays a mobile phone number if the cardholder responded or your ICD user ID if you responded.

Select the plus icon to view additional details on an alert, such as the authorized date and time. The value in the Type column represents the method in which the recipient was contacted: M (mobile) or E (email).

Enrollments

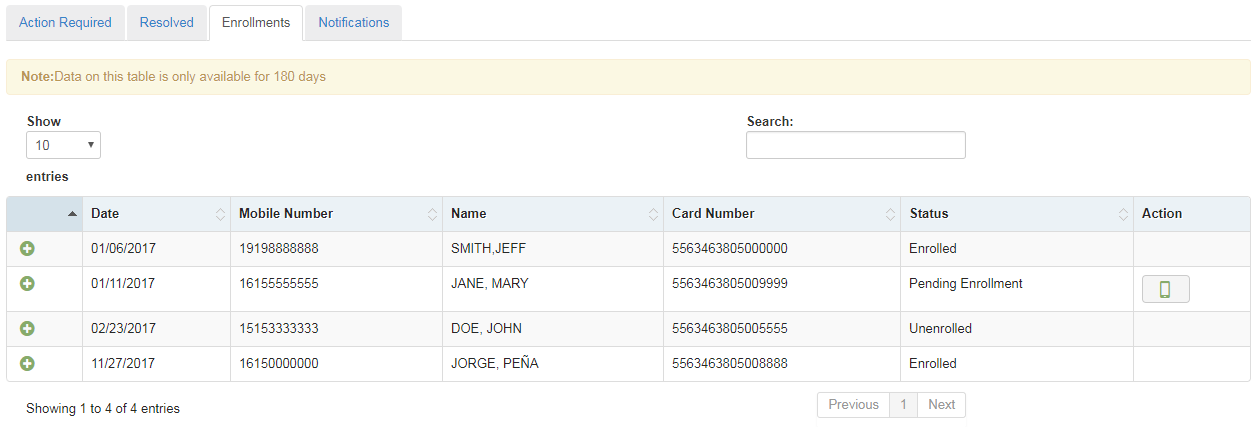

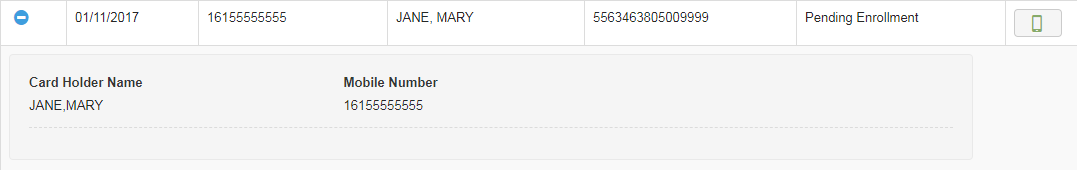

The Enrollments tab lists all cardholders who have received the initial enrollment email message. The values in the Status column identify whether the cardholder has responded IN to the number in the email. Data in this tab is available for only the past 180 days. Possible statuses include:

- Pending Enrollment: The cardholder has not responded IN. Select the phone icon to resend the enrollment email, if necessary.

- Enrolled: The cardholder has responded IN and has been enrolled.

- Unenrolled: Cardholder has texted STOP to opt out of the program.

Select the plus icon to view additional details on a cardholder (full name, mobile phone number, and email address).

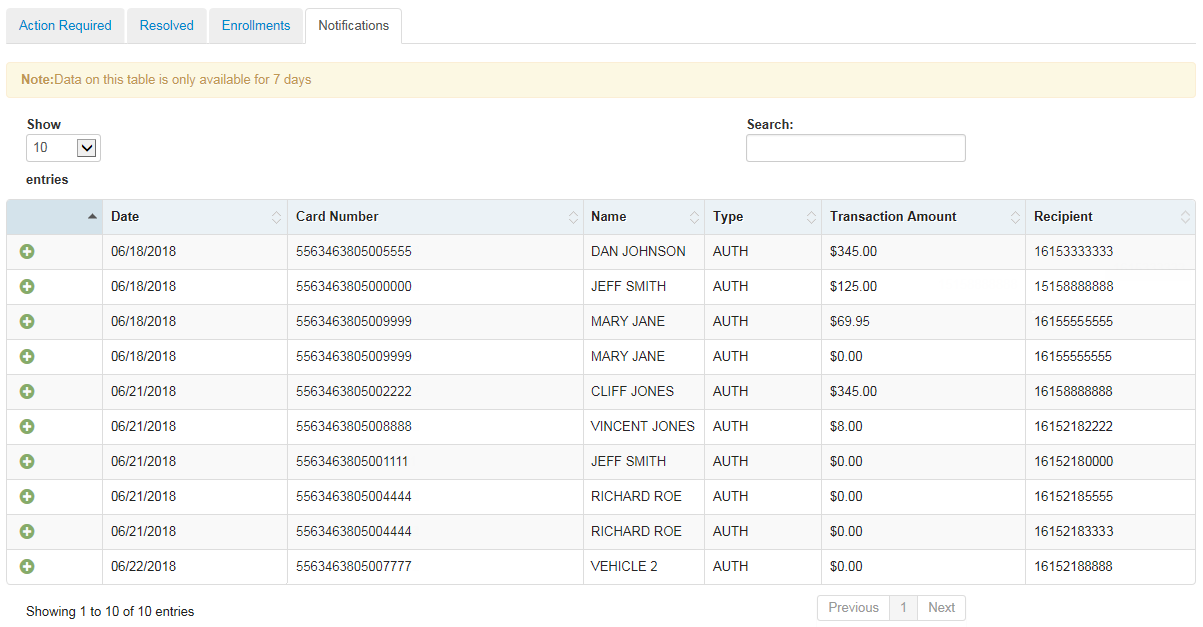

Notifications

The Notifications tab displays all decline notifications your cardholders receive. Use this tab to monitor card declines and perform resolution as needed.

Data in this tab is available for only the past seven days.

Select the plus icon to view additional details on a cardholder (full name, mobile phone number, and email address).