What is a Virtual Comchek?

The Virtual Comchek is a one time use virtual card. With Virtual Comcheks you can send cards via email through iConnectData (ICD).

If you have a Comdata account, you can use Virtual Comcheks to disburse money to your drivers. Your drivers use the Virtual Comchek to pay for expenses while on the road, such as lumper services, repairs, fuel, and fines. Use Virtual Comcheks as a flexible funds transfer service when a Comdata card isn’t available or suitable for a payment situation.

A fleet will initiate the Virtual Comchek Card in ICD, similar to what they are currently doing today. The fleet defines if the card must be used for an exact amount or “Up to” the created card value. The fleet also defines if it is open to use at any Mastercard location or a limited set of MCC’s.

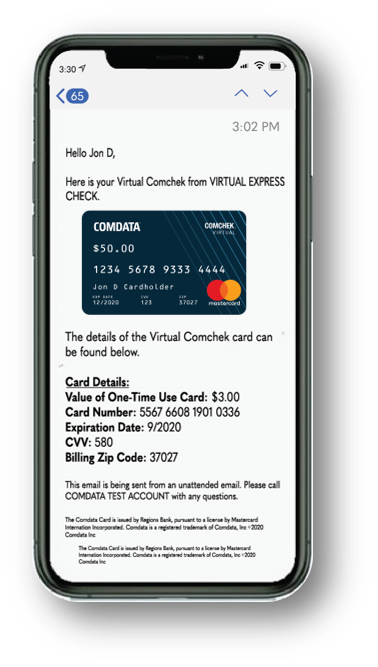

The driver receives the dynamic card image by email. This image will provide the card #, the dollar value of the card, zip code, CVV or card verification value (the 3 digits on the back of your credit card), and the name on the card.

The driver gives the details to pay for Over the Road (OTR) services, and the Virtual Comchek can be accepted at any Mastercard location. The fleet then gets a rebate based on the monthly amount spent, which is paid one month in arrears.

Virtual Comcheks are available for anyone in the fleet industry that needs to pay for a product or service, such as fleet drivers, carriers, and owner-operators.

Key benefits include:

- Minimize costs with managing check costs, check fraud, and labor.

- Easier and faster to process than paper checks thanks to automated processing and reconciliation.

- Reduce the risk of check fraud and gain security of single-use cards that are locked down using system controls.

Resources

Manage Virtual Comcheks

Use the materials below to learn how to manage Virtual Comcheks.

Frequently Asked Questions (FAQs)

Traditional Comcheks are presented as paper checks to pay for services, whereas a Virtual Comchek is a completely virtual form of payment delivered via email to a smartphone or tablet.

Using existing Point-of-Sale (POS) Mastercard payment systems, the card details are entered when presented by the driver, and the payment is processed.

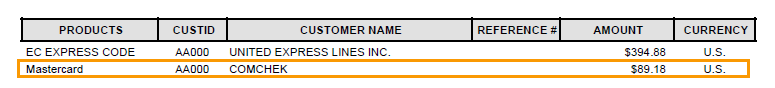

To view posted Virtual Comchek transactions, you can go to Manage > Card Maintenance and search for the Virtual Comchek Card Number OR Manage > Transactions > Real-Time Transaction History.

Transactions will display as Comchek, as pictured below.

A CNP transaction indicates a “Card Not Present” transaction, similar to a phone or web order, “CP”, or “Card Present” transactions indicate a physical card was swiped at the point of sale.

Instruct merchants to key in the numbers like a standard credit card. The expiration date and 3-digit code are provided on the Virtual Comchek.

First, verify the amount being charged does not exceed the value on the card, and if the amount is less, verify with your company that the option to charge the exact amount is not enabled.

No, a Virtual Comchek needs to be processed through a Point-of-Sale Mastercard payment system to be valid. If the merchant tries to process a Virtual Comchek like a paper Comchek they will receive an “Invalid” response.

Virtual Comchek provides a mobile payment solution that offers drivers and fleets greater control, visibility, and access to funds with rebates on qualified purchases, while offering merchants streamlined payment processing.